Scan

The Scan feature allows you to identify potential put options to kickstart your Wheel strategy.

Table of Contents

Scan Options

You have choices of two types of scans: (1) preset scans and (2) custom scans.

This is where the app is somewhat opinionated: scans are limited to put options only. The first reason is that agamotto is tailored for managing your Wheel strategy, and these always start with the sale of a put option. The second reason is that the starting put option is the only trade you actually have flexibility in choosing under the Wheel strategy.

- In choosing the initial put option, you have a choice over the (1) underlying, (2) strike, and (3) expiry. This we can scan for and optimise.

- If you have to roll the put, you can only choose the strike and expiry, in which case the underlying’s options chain should suffice in providing you the info you need.

- If you get assigned and need to start selling covered calls, you only have a choice over the expiry date and some strikes for the call option, depending on your cost basis. The underlying’s options chains should also suffice.

That said, logging your trades as a strategy still gives you access to the full capabilities that agamotto has for tracking your profits.

Preset Lists

Preset lists are provided for scanning (see table below). Most of these are lists of ETFs with options. ETFs were chosen because of their relative stability. In the event that you get assigned, you may be more comfortable (or at least, I am) holding an ETF instead of a small set of stocks. The remaining lists are lists of stocks in several popular ETFs. See the full list of tickers here.

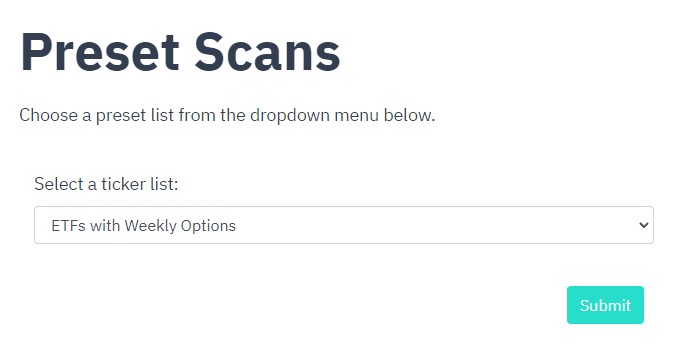

Scan: Presets

Preset lists:

- ETFs with Weekly Options

- ETFs - Price > $100 and Average Volume > 200k

- ETFs - Price between $50 and $100 and Average Volume > 200k Part 1

- ETFs - Price between $50 and $100 and Average Volume > 200k Part 2

- ETFs - Price between $20 and $50 and Average Volume > 200k Part 1

- ETFs - Price between $20 and $50 and Average Volume > 200k Part 2

- Stocks from Invesco QQQ Trust Series 1 with Price < $150

- Stocks from iShares MSCI USA Min. Volatility Factor

- Stocks from Vanguard Growth Index Fund ETF Part 1

- Stocks from Vanguard Growth Index Fund ETF Part 2

Each list has about 100 tickers. The reason is to fit the scans within the TD Ameritrade API’s rate limits.

Do not run multiple preset scans in quick succession. Wait approximately 1 minute after the completion of the first scan before launching another one.

Comign Soon: Create your own presets.

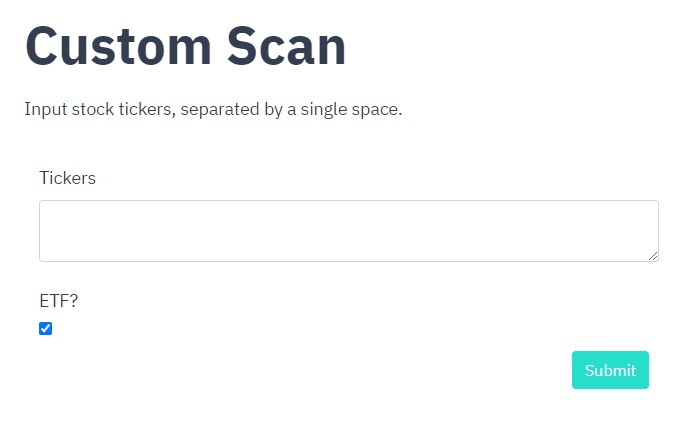

Custom Scans

Alternatively, you can run scans on a custom list of tickers. Be sure to check the checkbox if running a scan for ETFs - this applies to all tickers being scanned.

Scan: Custom

Tickers in Preset Lists

iShares MSCI USA Min. Volatility Factor ETF

AAPL, ABT, AEP, AJG, AKAM, ALL, AMAT, AMCR, APH, ATVI, BAH, BAX, BKI, BLL, BMRN,

BMY, BRO, CARR, CBOE, CERN, CHD, CHRW, CL, CMCSA, CMS, CPB, CSCO, CTSH, CTXS, D,

DELL, DGX, DLTR, DUK, EA, EBAY, ED, ES, EVRG, EXPD, FIS, FISV, FOX, GILD, GIS,

HRL, HZNP, IAC, IBM, ICE, INCY, INTC, JNPR, K, KMB, KR, LNG, LNT, MDLZ, MDT,

MKC, MMC, MO, MRK, NEE, NEM, NET, NLOK, NWSA, OMC, ORCL, OTIS, PAYX, PFE, PG,

PGR, PM, PTON, ROL, RSG, SBUX, SGEN, SJM, SO, T, TEL, TMUS, TRV, TW, VZ, WCN,

WEC, WM, WMT, WU, XEL

Invesco QQQ Trust Series 1

AAPL, AEP, AMAT, AMD, ATVI, CDNS, CERN, CHKP, CMCSA, CPRT, CSCO, CSX, CTSH, DLTR,

EA, EBAY, EXC, FAST, FISV, FOX, FOXA, GILD, INCY, INTC, JD, KDP, KHC, MAR, MCHP,

MDLZ, MNST, MRVL, MU, MXIM, NTES, PAYX, PCAR, PDD, PTON, QCOM, ROST, SBUX, SGEN,

SIRI, SPLK, TCOM, TMUS, WBA, XEL, XLNX

Vanguard Growth Index Fund ETF

[Part 1]

AAPL, ABNB, AFRM, AJG, AKAM, ALXN, AMAT, AMC, AMD, AME, APH, APP, ATUS, ATVI,

BAX, BF.A, BF.B, BKI, BLL, BMBL, BMRN, BMY, BSX, BSY, CBOE, CDNS, CERN, CGNX,

CHD, CHWY, CL, CNC, CPRT, CSGP, CTLT, CTXS, CZR, DBX, DDOG, DKNG, EA, EDR, EW,

EXAS, EXPD, FAST, FIS, FISV, FMC, GDDY, GDRX, HEI, HEI.A, HES, HLT, HZNP, IAC,

IBKR, ICE, INCY, INFO, INVH

[Part 2]

LKQ, LNG, LW, LYFT, LYV, MAR, MAS, MCHP, MGM, MKC, MNST, MQ, MRVL, MU, MXIM, NET,

O, OPEN, OSH, PATH, PAYX, PENN, PINS, PLTR, PLUG, PPD, PTON, PXD, QCOM, QS, RBLX,

RCL, REG, ROL, ROST, SBUX, SEIC, SGEN, SIRI, SNAP, SPLK, SSNC, TER, TJX, TRMB,

TRU, TTD, TW, TWTR, U, UBER, UDR, VMEO, WAB, WCN, WMG, WYNN, XLNX, XM, YUM, Z,

ZG, ZI

ETFs with Weeklies

AGQ, AMLP, ARKF, ARKK, ASHR, BLCN, BLOK, DIA, DUST, EEM, EFA, EMB, ERX, EWC, EWH,

EWU, EWY, EWZ, FAS, FAZ, FEZ, FXE, FXI, GDX, GDXJ, GLD, HYG, IAU, IBB, ICLN, IEF,

IGV, IWF, IWM, IYR, JDST, JETS, JNUG, LABD, LABU, MJ, MSOS, QQQ, RSX, SDS, SIL,

SILJ, SLV, SMH, SPXU, SPY, SQQQ, SVXY, TAN, TBT, TECS, TLT, TQQQ, TZA, UNG, URA,

UUP, UVXY, VIXM, VIXY, VXX, XLC, XLE, XLF, XLI, XLK, XLY, XME, YINN

ETF: Above $100, Average Volume > 200k

ACWI, AGG, ARKK, ARKW, BLV, DIA, DPST, DVY, EDV, EFG, EMB, ESGU, FAS, FDN, FTEC,

GBIL, GLD, IBB, ICVT, IEF, IEI, IGV, IJH, IJJ, IJR, ITOT, IUSG, IVE, IVV, IWB,

IWD, IWF, IWM, IWN, IWO, IWP, IWS, IYR, IYT, IYW, JNK, LQD, MBB, MDY, MINT,

MTUM, MUB, OIH, QQQ, QQQM, QUAL, REMX, RSP, RWR, SCHA, SCHB, SCHG, SCHX, SDY,

SHV, SKYY, SMH, SOXX, SPXL, SPY, SSO, STIP, TIP, TLT, TQQQ, UPRO, URTY, VB, VBR,

VCLT, VGT, VHT, VIG, VLUE, VNQ, VO, VOE, VOO, VT, VTI, VTV, VUG, VV, VXF, VYM,

XBI, XLI, XLK, XLV, XLY

ETF: $50-100, Average Volume > 200k

[Part 1]

AAXJ, ACWX, ARKF, ARKG, ARKQ, BBEU, BBJP, BIL, BIV, BND, BNDX, BOIL, BRZU, BSV,

CIBR, CQQQ, CWB, CXSE, DDM, DGRO, DGRW, DXJ, EEM, EEMV, EFA, EFAV, EFV, EMQQ,

EMXC, EPP, EWJ, EWT, EWW, EWY, EZU, FIXD, FLOT, FNCL, FNDX, FTCS, FTSM, GSLC,

GSY, GUSH, HDV, HYD, HYG, HYS, IAGG, IAT, ICSH, IEFA, IEMG, IEUR, IEV, IGIB,

IGLB, IGSB, IHI, IJK, IJS, IPO, ISTB, ITB, IUSB, IUSV, IVW, IWR, IXG, IXN, IXUS,

IYF, JEPI, JMST, JNUG, JPST, KBE

[Part 2]

KBWB, KRE, LABU, LIT, LMBS, MCHI, MDYV, MOAT, NAIL, NEAR, NOBL, NUGT, ONEQ, PBW,

PKW, QCLN, QLD, RPV, SCHD, SCHM, SCHO, SCHP, SCHR, SCHV, SCHZ, SCZ, SHY, SLQD,

SLYV, SPHB, SPLG, SPLV, SPTM, SPYG, SVXY, TAN, TECL, TFI, TMV, TNA, UCO, UDOW,

USIG, USMV, USRT, UWM, VCIT, VCSH, VDE, VEA, VEU, VFH, VGIT, VGK, VGLT, VGSH,

VMBS, VNLA, VNQI, VONG, VONV, VPL, VTEB, VTIP, VTWO, VWO, VWOB, VXUS, WCLD, XHB,

XLB, XLC, XLP, XLU, XOP, XRT

ETF: $20-50, Average Volume > 200k

[Part 1]

AGQ, AMLP, ANGL, ARKX, ASHR, BAB, BDRY, BKLN, BLOK, BOTZ, BSCL, BUG, BWX, CHIQ,

CLOU, COMT, COPX, CPER, CWEB, DBB, DBEF, DFAC, DFAU, DJP, DOG, DRIV, DRN, DUST,

EBND, ECH, EIDO, EMLC, EMLP, EPI, ERX, ESGE, EWA, EWC, EWD, EWG, EWH, EWI, EWL,

EWM, EWP, EWQ, EWS, EWU, EWZ, EZA, FALN, FAZ, FEZ, FLRN, FNDE, FNDF, FPE, FREL,

FTGC, FTSL, FVD, FXI, FXO, GDX, GDXJ, GOVT, GSIE, GUNR, HEFA, HNDL, HYLB, IAU,

ICLN, IDV, IGE, IGF, ILF, INDA, INFL, IQLT, IVLU, IVOL

[Part 2]

IXC, IYE, JETS, KIE, KSA, KWEB, LABD, MLPA, MSOS, NUSI, PAVE, PCY, PDBC, PEJ, PFF,

PFFD, PICK, PTBD, PULS, PXH, PZA, QQQJ, QYLD, RDVY, REET, REM, RSX, RWM, RWX, SCHC,

SCHE, SCHF, SCHH, SDOW, SHYG, SIL, SIVR, SJNK, SLV, SOXL, SPAB, SPDW, SPEM, SPHD,

SPHQ, SPIB, SPIP, SPLB, SPMB, SPMD, SPSB, SPSM, SPTI, SPTL, SPTS, SPXS, SPYD, SPYV,

SRLN, SRVR, SUSB, TIPX, TMF, TOTL, TUR, TZA, URA, USFR, USHY, USO, UUP, UVXY, VIXY,

VRP, VXX, XLE, XLF, XLRE, XME, XSOE, ZSL